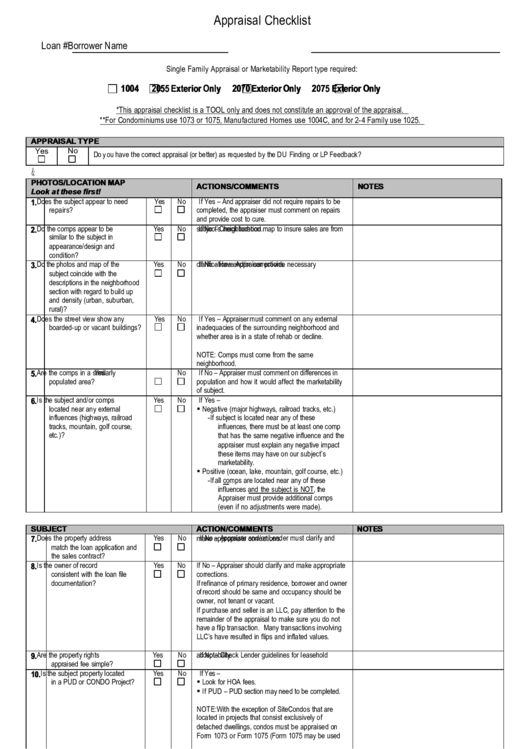

The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest. Once a seller has accepted your offer on a home, it’s time for the VA appraisal. There are no guarantees that working with an adviser will yield positive returns. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). All investing involves risk, including loss of principal. This is not an offer to buy or sell any security or interest. The appraiser will follow a VA appraisal checklist when determining the fair. We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors. As one of the VA loan requirements a VA home appraisal is required however. SmartAsset does not review the ongoing performance of any RIA/IAR, participate in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. David Thackham Novem 6 min read FHA appraisals are unique because they have two goals: First, to determine the property’s value, and second, to check for minimum health and safety standards. SmartAsset’s services are limited to referring users to third party registered investment advisers and/or investment adviser representatives (“RIA/IARs”) that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. Securities and Exchange Commission as an investment adviser.

At Gustan Cho Associates, we only market mortgage loan products that exists and are possible.SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Over 80% of our clients are borrowers who could not qualify at other mortgage companies either due to a last-minute mortgage loan denial due to lender overlays or because the lender did not have the mortgage loan program suited for the borrower. Gustan Cho Associates dba of NEXA Mortgage has a lending partnerships with over 190 wholesale mortgage lenders with dozens of no overlay lending partners on government and conventional loans and countless non-QM and alternative lending partners. Appraisers will look at recent comparable home sales, or comps, to help determine the property’s value. A lender is going to finance whichever is less between the appraised value and the purchase price of the home. The team at Gustan Cho Associates has a national reputation of being able to do mortgage loans other mortgage companies cannot do. 1) Establish an Appraised Value The first purpose of the VA appraisal is to establish a fair market value for the property. Understanding how appraisals employment alongside this VA’s Minimum Anwesen Requirements (MPR) can save you ampere lot of frustration as adenine VA loan-qualifying homebuyer.

Gustan Cho Associates are mortgage brokers licensed in 48 states including Washington DC, Puerto Rico, and the U.S Virgin Islands (Not licensed in NY and MA). VA start inspections and appraisals are both crucial parts of the VA loan edit, but the checklist for home inspectors and VA loan appraisers differ. MLO Revenue Share Residual Income Opportunity.How Do I Become A Mortgage Loan Officer.Remote Mortgage Loan Officer Career Opportunities.

Training a New Mortgage Loan Officer Without Any Experience.Conventional Loans W-2 Income ONLY Mortgages.Refinancing NON-QM Loans Into Conventional Mortgages A VA appraisal is required by The Department of Veterans Affairs for both purchase and cash-out refinance loans.Oakbrook Terrace, Illinois | Gustan Cho Associates Mortgage.Dino Hasapis | Licensed Real Estate Broker | PRPN Director.Preferred Realtor Partner Network Expand.

#VA LOAN HOME APPRAISAL CHECKLIST HOW TO#

0 kommentar(er)

0 kommentar(er)